Err_Address_Unreachable: Best Methods for Fixing Error

Are you experiencing the “err_address_unreachable” message when attempting to visit a website? Rest assured, many others encounter this issue as well. This error, which happens for various reasons, has thankfully…

3 Things Any Brand New Investor Needs to Know

Investing has its jargon, its theories, and its strategies. All these add up to what seems like a high barrier to entry. Anyone looking from the outside in might be…

Super Mario 64 Unblocked: How to Play Online?

Come on over, everyone! Assemble here and prepare to immerse yourselves in the realm of iconic gaming – Super Mario 64 unblocked! It is a true trailblazer, possibly the most…

Vimms Lair: Your Portal to Vintage Gaming Memories

Do you have a passion for playing old-school video games? Are you in search of that nostalgic gaming atmosphere, filled with the classic titles from yesteryear? If so, your search…

How to Fix If WCOFun.Net Does Not Work?

In today’s age where producing digital content is widespread, there is a multitude of venues for effortlessly enjoying your preferred shows. Similar to other services, WCOFun.Net stands out as a well-known…

Unblockit: Is it Legitimate and Safe Proxy Service?

Unblockit offers a solution for circumventing site restrictions. Techniques such as VPNs, proxies, and the Tor network are capable of accessing blocked sites. This guide discusses the security and legal…

What Does NFS Mean on Wizz? Simple Guide

Whenever we discuss the utilization of shortened forms on social media, there tends to be a mix-up among the terminology. Wizz is an online networking site that facilitates the coming…

8 TOP OnlyFans Search Engines Of 2024

Are you in search of top-tier search platforms to locate OnlyFans content creators in 2024? The internet is home to a variety of OnlyFans search tools, each possessing its unique…

Indown.io: Discovering Instagram Content Downloader

Are you someone who regularly uses Instagram and struggles with downloading reels, pictures, and videos? Look no further, as indown.io is here to help! Indown offers an easy solution for…

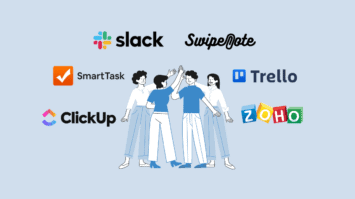

21 TOP Team Management Software in 2024

Larger projects and duties can be simplified with the help of Team management software, which automates and streamlines operations. Additionally, these tools support the development of project reporting, Teamwork, and…

The Power of Automation in Revenue Management

Revenue management is becoming increasingly challenging, especially as the US faces an unprecedented accountant shortage. According to Fortune, the country is short of 340,000 accountants, resulting in errors in earnings…

20 TOP Free Live Streaming Apps for iPhone

in Future projections suggest that the live-streaming market will continue to grow and attract more viewers. Live streaming used to be only for personal computers, but these days, you can…

Can Fallout Shelter Cheats Assist You In Playing?

Hello, people who live in the basement! Here are some of the best tips and tricks, cheats for Fallout Shelter. This simple guide will help you level up faster, get…

16 Top Free Speech to Text Apps of 2024

Users can easily quote and write without typing, thanks to speech to text Apps technology. People who are visibly disabled or need help using devices can also benefit from it….

RedGifs: Your Most Iconic Animated Moments on RedGIF

RedGIFs is a digital service focused on the uploading and dissemination of animated GIFs. It’s commonly described as the GIF equivalent to Imgur because it shares a comparable layout and…

Quizizz Join: Participate and Assess Your Knowledge

Numerous individuals are eager to assess their understanding through a more engaging and dynamic approach. In such a case, it’s worth venturing a bit to discover one of the most…